Founders Last Gift to Shareholders

Profitable Net-Net with 150% of MC in Cash & Securities -$2814.T

Do you love massive buybacks?

In 2022, through Sato-san's will, 32% of the company's float was transferred back to the company at no cost—essentially a free 32% share buyback. There is no way to describe this but as a massive gift to shareholders.

Reading this piqued my interest — I had to dig further.

Despite the significant time since Sato-san’s passing and the recent share price appreciation, the market has yet to fully reflect the value of this transfer. This delayed market recognition likely stems from COVID-19's impact on profitability in the company's tea extract segment. However, the business is now showing clear signs of reacceleration.

We can buy an stable profitable business for an absurdly cheap valuation — with cash and securities making up 150% of the market cap. I love setups with multiple ways to win—or multiple outs in poker terminology. In this case several catalysts could drive returns: earnings reacceleration, a potential buyout, or shareholder-friendly changes sparked by TSE reforms and activist pressure. Each 'out' increases the odds of success, while the deep discount protects our downside. Given this compelling risk-reward profile, I've added the stock to my net-net basket.

Sato Food Industries - $2814.T

Share price at the time of writing ¥2150

Market Cap: ¥8.6 billion

Cash: ¥9.9 billion

Investment Securities (IS): ¥3.8 billion

NCAV + IS: ¥14.8 billion

P/(NCAV+IS): 59%

P/BV: 47%

Dividend Yield: 1.7%

With a negative enterprise value of -¥4 billion we are being paid to buy this business. Surely then, this must be some sort of cyclical, barely profitable value destroying corporation? No!

Before I dive deep into the business I would like to put in a few words about corporate reforms in Japan.

Japan: The End of the Value Trap Era

Japan is the most exciting opportunity in public markets. After decades of share price stagnation (not earnings) the Tokyo Stock Exchange (TSE) reforms are driving a huge wave of shareholder improvements and M&A. The TSE is publishing a list of companies that have complied with its capital improvement initiatives, using social pressure to encourage participation. Activists, like Dalton Investments, are taking large stakes and putting pressure on management. Not a day seems to pass without a new buyout, dividend or buyback announcement in 2025.

TSE has almost 4,000 listed companies. Many trade below book value or even below cash. In the coming decade a huge proportion of these will be bought out. I want to buy a basket of the most profitable, growing yet cheapest Japan small-cap stocks to get exposure to this trend without company specific risk.

In the context of stretched valuation in the US I find the idea of holding a basket of these net-nets incredibly appealing. In the appendix I provide a more thorough overview of these reforms and provide links with more resources. I have found a few cool charts for you.

The Business: Stable & Profitable

The core operating business has been profitable for the past 30+ years. In 2009, during the GFC, they were caught up in a financial scandal due to the incompetent CEO who replaced founder Sato in 2007. These losses are in no way reflective of the underlying economics of the operations.

The Products

Sato makes various drink extracts. They have 3 factories and several in-house technologies. In fact, they were the first to invent and patent alcohol powder. Whilst dry alcohol is a small part of sales, I think this highlights that they are not some dinky low quality manufacturer.

15% of their sales are to Ito En, Japan's largest tea distributor. Presumably they sell tea extracts to Ito En which end up in many products like these:

Revenue

Sales across all non-tea categories are remarkably resilient — displaying almost subscription-like consistency. Even the pandemic failed to make a dent.

However, the pandemic clearly derailed the tea extract business — sales declined 1 billion. The company cites 2 reasons for this decline.

Less people eating out.

More people working from home.

The decline in spending on eating out is now reversing and more people are back to working from the office.

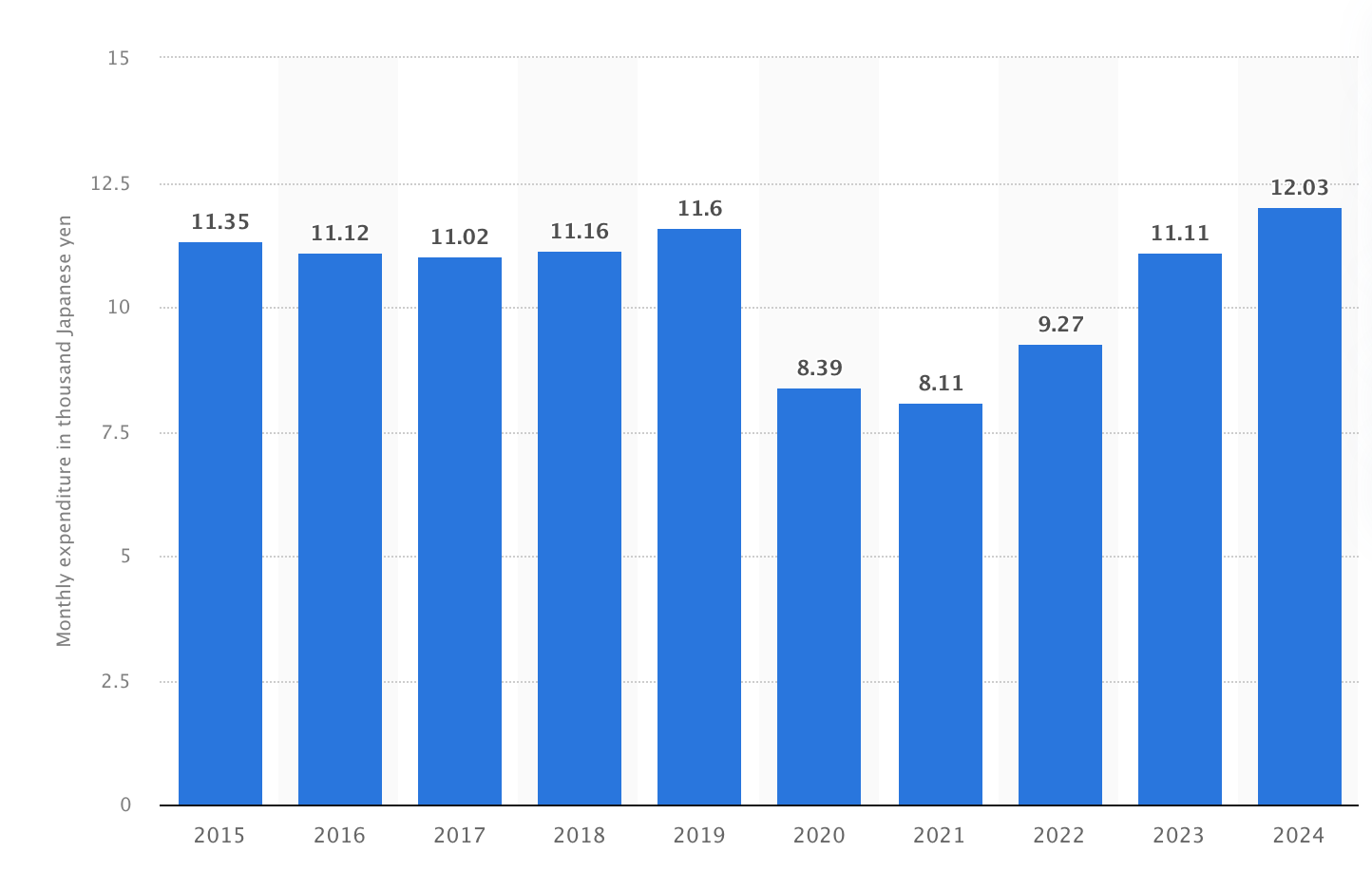

Ito En has also provided an interesting slide on bottled tea specifically. Traditional leaf tea has been in a steady decline, but convenience options, such as bottled tea or instant tea have gained popularity.

To me this is enough evidence to suggest that sales will recover over the next few years. Since this is a manufacturing business, much of the recovery should translate nicely into EBIT via operating leverage.

However, there is one thing to note here. Customer concentration in the tea extract segment is particularly high and there is a curious discrepancy in sales decline between Ito En and other customers.

Ex-Ito En sales declined during the first year of the pandemic but Ito En sales remained flat. During the second year the exact opposite happened. I suspect Ito En could have overstocked in 2021 betting on a recovery which did not materialise.

I caution against reading too much into this. Whilst certainly curious, I don't think there is anything thesis breaking here. The relationship with Ito En is a longstanding one. So much so that Sato Foods uses Tully’s gift card as a shareholder benefit (announced Nov 2024).

Note: Ito En owns Tully’s in Japan - 800 stores

Sales to Ito En and sales of tea extract to other partners are recovering. As mentioned before I believe this recovery is going to continue.

Profit Margins

But Mallard, even if sales recover, what about the declining margins?

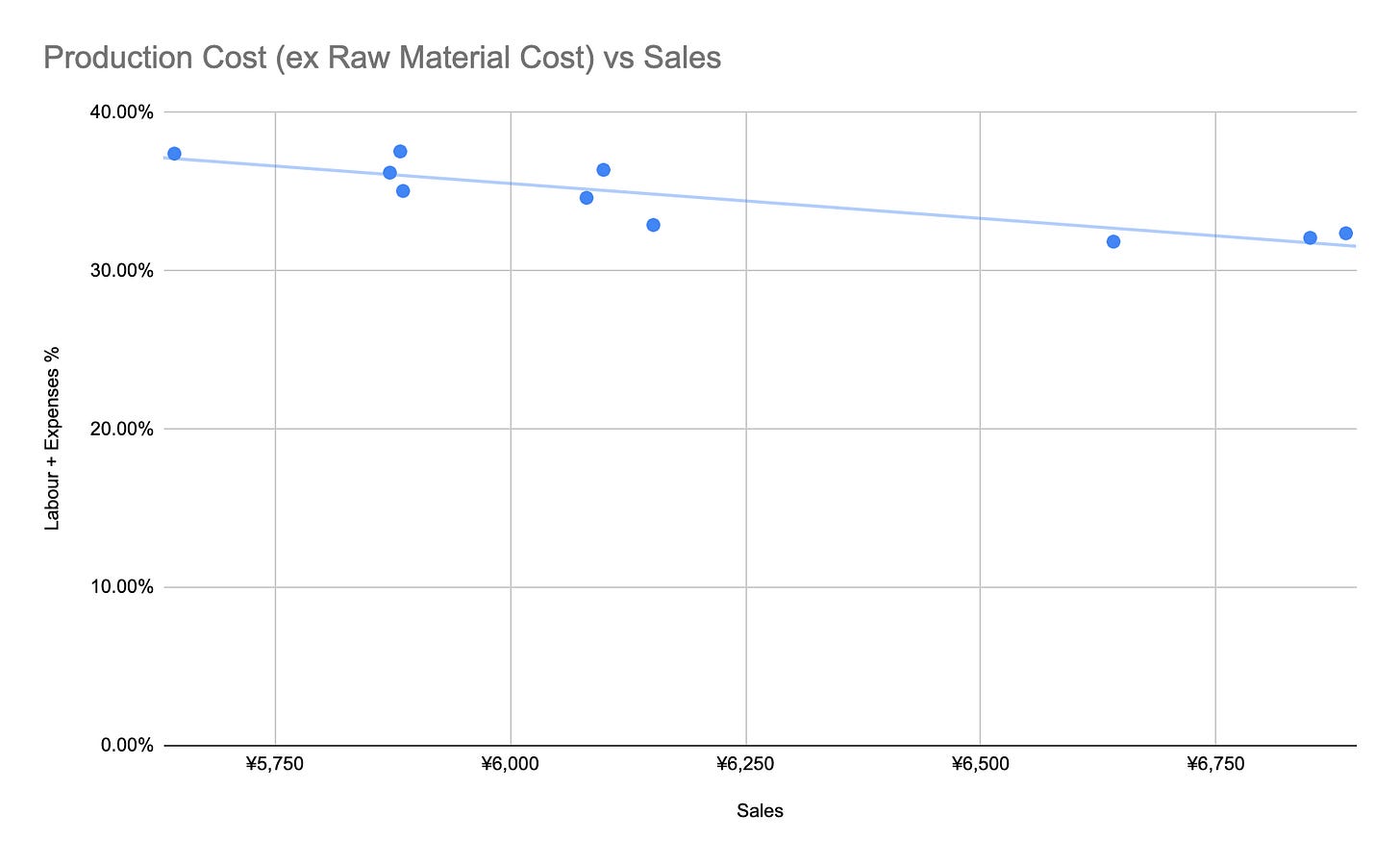

This is a manufacturing business. Higher utilisation translates to higher margins via economies of scale.

You can clearly see this if you plot fixed costs vs revenue.

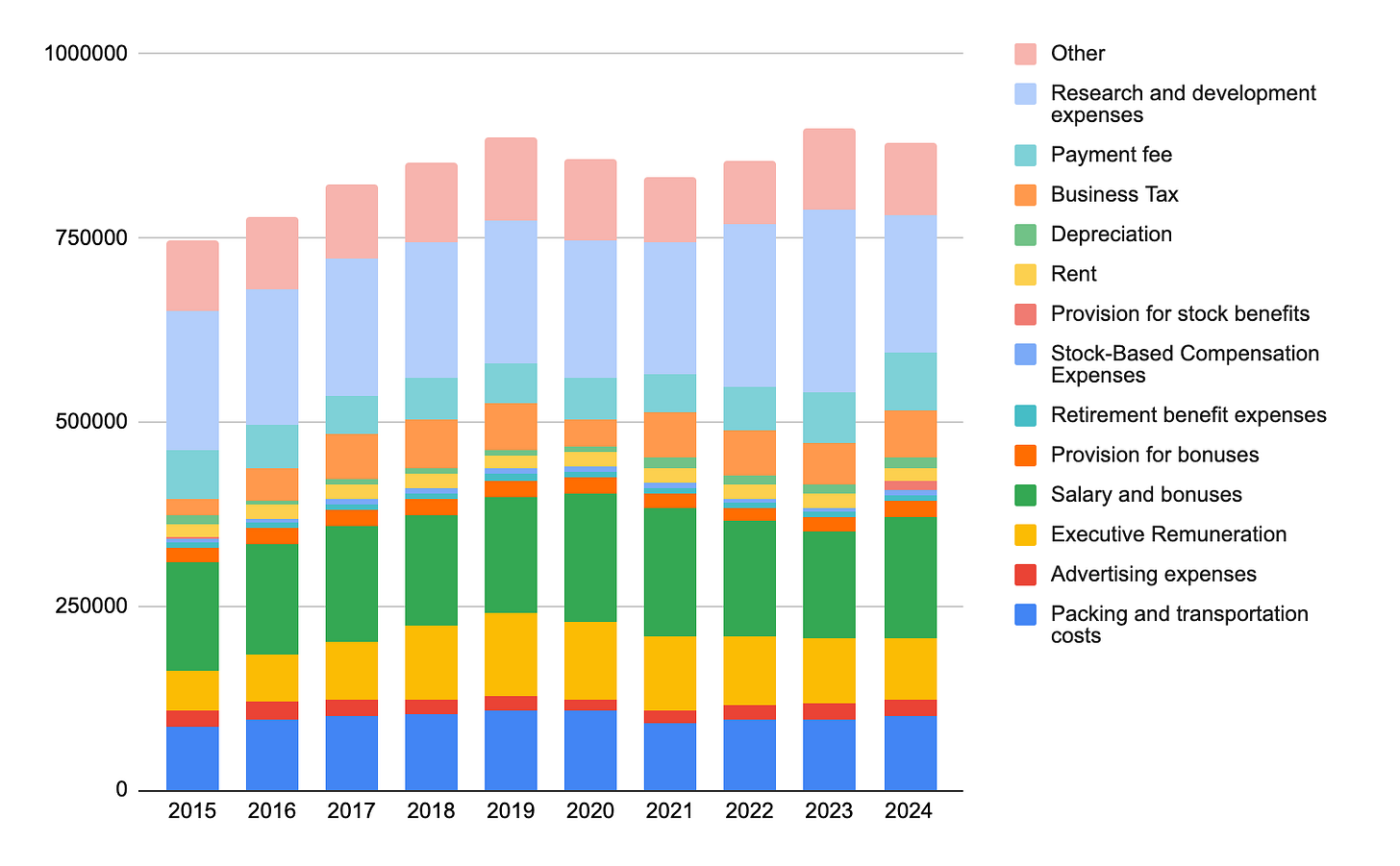

It is clear that lower sales are primarily responsible for the recent decline in margins. The only slight concern is rising wages which are part of the production costs.

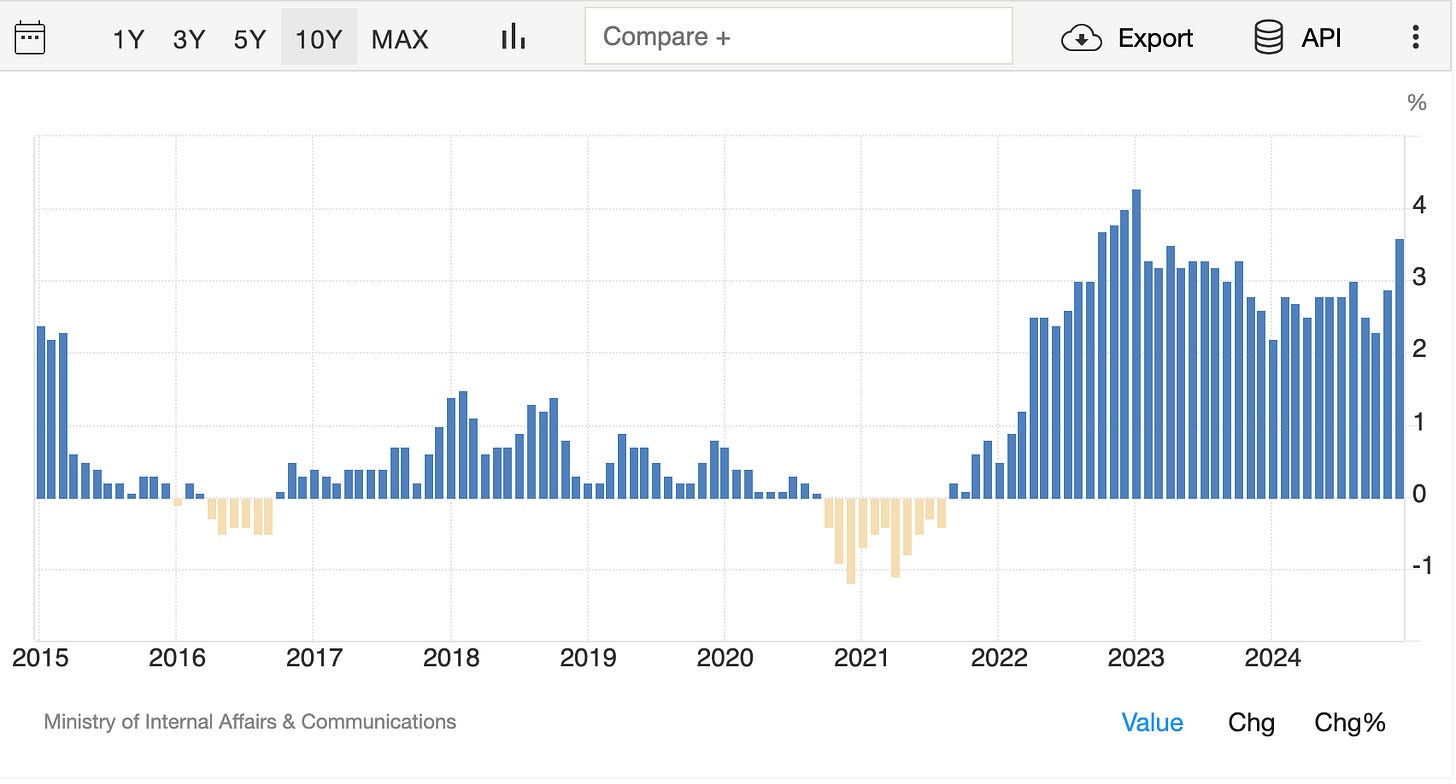

Wages have crept up slightly. The most recent jump from 2023 to 2024 was around 100 million yen. Enough to almost offset the rising sales. This is caused by the recent inflationary environment in Japan, with wage hikes becoming more common.

Overall a bit of inflation is healthy for the economy—it encourages spending and investment rather than hoarding cash. Japan has struggled with deflation for over a decade, so this shift is a positive development. While some businesses are hesitant to raise prices due to Japan’s traditionally rigid business culture, which prioritises stability, price adjustments will likely become more normalised over time. I expect Sato will also be able to increase prices to offset inflation.

Notably, these wage raises dont appear to be excessive compared to the minimum wage increases nationwide.

Operating costs have not ballooned and executive pay has stayed flat since 2019. This to me is very important. I like to see that management is not taking advantage of shareholders.

Shareholdings

I like to see an open register in my net-net portfolio candidates. This leaves the door open for activists to enter.

In this case we know that the founder has passed away leaving the stake to the company. The remaining 2 top shareholders are likely companies that Sato does business with.

The 3rd largest shareholder is a prominent Japanese company named Hikari Tsushin which translates to "Optical Communications Co., Ltd." in English. Known for its investments across various sectors, Hikari Tsushin is not an activist investor but could guide management toward better policies. The company emphasizes shareholder returns in its investor relations materials and has recently increased its position slightly.

While it's risky to rely on others' opinions when selecting stocks, I find it reassuring to see a vote of confidence from investors who share similar priorities.

Other Shareholders:

RAIZNEXT which Hikari Tsushin also has a 22.6% stake in has been selling its shares. This is a positive as it creates liquidity.

Yoshi Yuhara is a former director complicit in the 2009 scandal which caused the 5.5 billion loss.

Kyoko Sato must be related to the founder.

In summary, the main drawback is the high concentration of ownership among the top 10 shareholders and the absence of an activist investor. However, the lack of a single controlling shareholder block is a positive sign.

Valuation

Cash and securities alone are worth ¥14.7 billion.

The core business generates between ¥0.7 and ¥1 billion in normalised EBIT.

Book value, excluding cash and securities, stands at ¥4.5 billion.

ROIC (ex-cash, pre-tax): 14–20%, which translates to 10–14% after applying a 30% tax rate. Quite decent for a manufacturing business.

1. Book Value Approach

As a rule of thumb if ROIC > 10% I think the business should trade at least at book value. It makes no sense to discount assets if they produce returns greater than what you can achieve in an index fund.

Based on this approach, valuing the core operating assets at a book value just over one, gives us an valuation of around ¥20 billion.

2. Operating Multiple Approach

Applying a conservative EBIT multiple of 6x results in a market capitalisation range of ¥3.5–6 billion.

This implies an valuation of ¥18.2–20.7 billion.

That makes the conservative upside between 110%-140%.

Conclusion

These are very crude estimates. I am well aware of the perils of a sum-of-the-parts valuation. Without a catalyst it might be hard to unlock this value. This is why I hold this stock as part of a basket of net-nets. Yet, investing in net-nets can result in good returns over time even without catalysts. The TSE reforms and potential earnings growth are the cherry on top.

Rest in peace Sato-san!

Disclaimer: Nothing discussed here constitutes investment advice and is for informational purposes only. I am not a qualified financial advisor. I may trade securities discussed at any time without prior notification. Always do your own due diligence and seek a qualified financial advisor before making investment decisions.

Appendix

Japan’s Corporate Reforms

Instead of writing this myself, I’m sharing an excerpt from Nippon Active Value Fund’s annual report, which provides an excellent overview.

In early 2023, the Tokyo Stock Exchange (‘TSE’) mandated that all companies disclose information regarding their “Action to Implement Management that is Conscious of Cost of Capital and Stock Price.” While not a catchy title, this initiative was significant, in that it not only compelled companies to assess formally and disclose key metrics such as cost of capital and return on equity (‘ROE’), but also challenged companies trading with a price/book (‘P/B’) ratio persistently below 1.0x to create concrete plans to achieve the magic 1.0x ratio.

The TSE continued its reform campaign during the week of 15 January 2023 with two new initiatives: the publication of a list of companies that have complied with its “capital improvement plans” and the introduction of a new demand that all companies listed on the Prime Market disclose key information in English, starting in March 2025.

In a uniquely Japanese way, rather than naming and shaming the companies which have chosen not to comply, the TSE opted for positive reinforcement by publishing a list of companies that had chosen to comply. This approach, while seemingly indirect, effectively creates an implicit “naughty list” for non-compliant companies, leveraging social pressure and the desire to avoid reputational damage as powerful motivators for change. The effectiveness of shame and peer pressure in shaping corporate behaviour in Japan should not be underestimated.

The TSE list shows that some 851 companies have already made public disclosures, while another 264 have stated their intention to do so. Rising Sun Management Ltd, NAVF’s Investment Adviser, and Dalton Investments Inc, our frequent co-investor, have actively engaged with our non-compliant portfolio companies, urging public disclosure, and even submitting shareholder AGM proposals for companies which refuse. While the headline numbers are encouraging, the devil lies in the details, with multiple examples of companies disclosing plans that were completely lacking in details of concrete measures.

These reforms are working. Companies are unwinding cross-shareholdings and increasing cash payouts. Boards are becoming more independent. Here are a few interesting charts.

Board Accountability is Improving

Buybacks and Dividends are Rising

Activists are Storming Japanese Boardrooms

Buyouts Are Surging

In 2024, Japan’s largest-ever management buyout (MBO) deal negotiation began as the founding Ito dynasty and multiple private equity firms joined forces to fend off a $47 billion takeover bid from Canada’s Alimentation Couche-Tard. This is not the only such setup. Another situation involves Helios Techno $6927.T where activists united to block a takeover bid which valued the company at a 73% premium.

has written a nice summary of this situation.Capital Allocation in Action

Here’s what happens when a cash-rich company starts paying out more.

Thanks to

for highlighting this one and many other such situations. You should check his work out if this is the first time you have encountered this theme.Share price reaction:

Sources

GuruFocus. How Bad Did Net-Nets Do in the Crash? Link

MSCI. Have Corporate Reforms in Japan Delivered Shareholder Value? Link

Janus Henderson Investors. Japanese Equities: Corporate Governance Reform and the Biggest Surprise of the Year. Link

Nomura Connects. Japan Cross-Shareholdings Enter a Dynamic New Era. Link

Nikko Asset Management. From Taboo to Trend: The Rise of Shareholder Activism in Japan. Link

I like Sato Foods 2814, but recently sold. I still think its very hard to lose with a name like this. Only reason I sold is because they announced a Shareholder benefits program that was pretty generous and as a foreigner, I'm not eligible to receive these. If you own 100 shares, you get 2,000 yen gift card to tully's coffee ever year. Equal to a 1% dividend! I prefer they just pay the 1% dividend instead!

I still think this name does fine going forward

Many thanks ! appreciate the write-up—very insightful. I had a quick question regarding the $3.5B in investment securities—could you clarify what the key components of that are? Also, I was curious about the $1.4B in bankruptcy and rehabilitation—could you provide some context on what that includes?